If the withdrawal amount is less than INR 50000 then no TDS is cut. Withdrawal to purchase a second house provided the first house is sold or disposal of the property has taken place.

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

The provision to withdraw money from EPF accounts was first announced in March 2020 under the Pradhan Mantri Garib Kalyan Yojana PMGKY According to the withdrawal rules EPFO members can take non-refundable withdrawals of up to three months basic earnings and dearness allowance or 75 percent of the EPF account balance whichever is smaller.

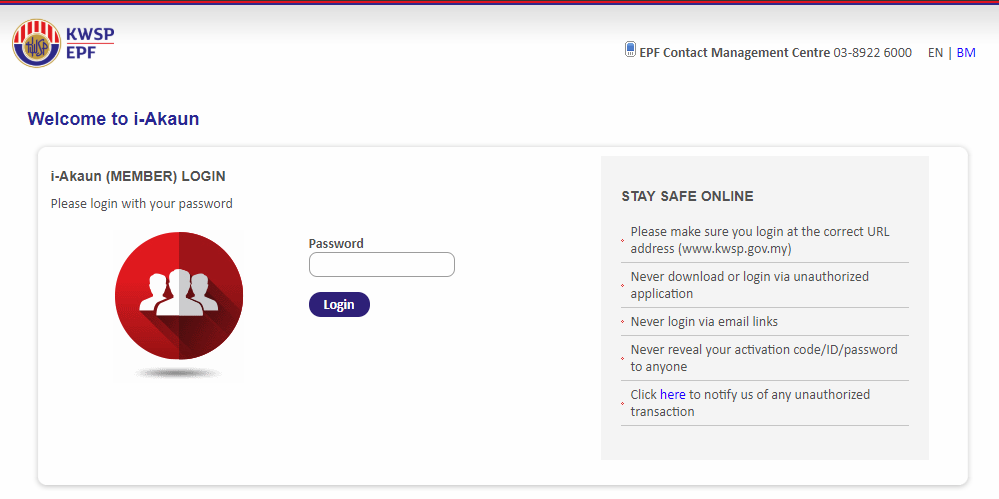

. Withdrawal to purchase the first house. Form KWSP 9C AHL and Checklist also known as the EPF Withdrawal Form. Minimum savings balance of RM500 in Account 2.

The original copy of the Sale Purchase Agreement SPA. Provide bank account details as per the EPF account. A civil servant placed under the pension scheme.

The facility of passbook is not available for members of. 70 of your salary contribution is transferred here. Sales and Purchase SPA original copy.

Upon a person becoming disable or in the event of death. Here are some of the documents that you will need to withdraw the funds from your EPF Account 2. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

The main difference between these two accounts is that EPF Account 1 is meant for your retirement. For example if you are buying a property from Kinta Properties Olive Price of Olive. Better withdraw from EPF account 2 to housing loan as following points.

EPF withdrawals before five years of continuous service attract TDS. One mobile number can be used for one registration only. To qualify you would.

Effective from 2nd January 2001 applicants can also withdraw from Account II to purchase or build their second house on condition that the first house which was funded from their EPF savings has been sold. ReduceRedeem Housing Loan. Well there are two criteria under this improvisation-.

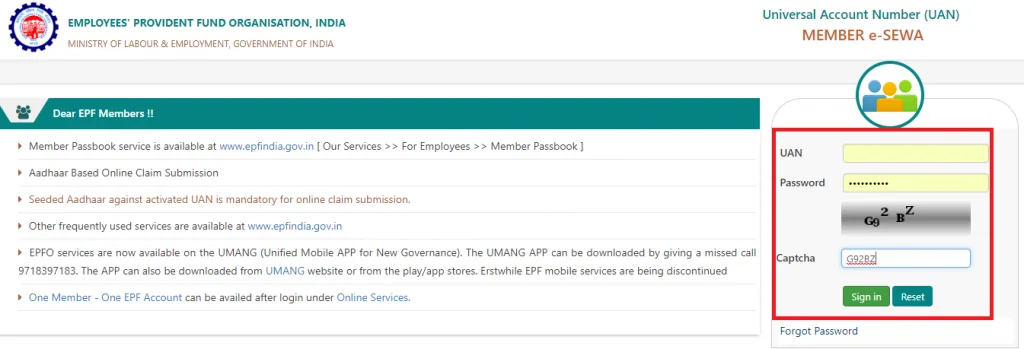

You can withdraw from your EPF to service a home loan if youre purchasing residential property. Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online. Fill the withdrawal form online at the EPF member portal.

You must be an active EPF subscriber for at least 10 years. EPF withdrawal form Form KWSP 9C AHL. As EPF is usually the dominant product for building ones retirement corpus you must re-evaluate the option to withdraw as it will impact the compounding of your returns.

The applicable TDS rate is 10 on withdrawals if the PAN details are furnished. Any queries can be sent to the EPF via e-mail. The return rate on residential property is appreciate in line with inflation around 5 to 7 yearly rental around 3 to 5 yearly.

EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. Photocopy of your Identification Card myKad or Passport. This type of withdrawal involves you withdrawing money from your Account 2 to finance your monthly installments for your housing loan which was taken up either to buy a new house or build a new one.

You can withdraw the difference between the SPA house price and the housing loan amount which is typically 90 as most first time home buyers have to submit a 10 down payment plus 10 on the price of the house. Min is 8 to 12 EPF is 6 for year 2011 around 5 to 6 over past few years Obviously ROI for property is highly then in EPF. Submit the duly filled form and the withdrawn amount will be credited to your bank account within 15 days.

Here the funds will be divided between the two accounts. In case PAN details are not provided then the rate is 34608. There are many circumstances and conditions for the maximum amount allowed but the withdrawal guideline is either 10 of the house price or all of Account 2.

There are also different withdrawal rights according to the various EPF accounts Akaun 1 and Akaun 2. Before 5 Years of Service. A member can view the passbooks of the EPF accounts which has been tagged with UAN.

A copy of the letter of loan approval from your end-financier. With around 25 years of your loan tenure left you have already paid the majority of the interest component and further EMIs will have a higher share of the principal. However on the safer side wait for it to turn more than 5 years.

When a person migrate to another country. Get the Aadhaar authenticated by the employer and link it to UAN. Withdrawal from Account 2 to build a house.

Buying a house. The full list of TCs plus the necessary supporting documents can be found at KWSPs website. On the other hand the remaining 30 is allocated to EPF Account 2.

Contributors need to go to the EPF to apply for the monthly withdrawal only once and subsequent payments would be directly credited to their. The house youre going to improvemodify should be at least 5 years. EPF Account 1 receives more.

WITHDRAWAL FOR SECOND HOUSE.

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

Construction Of House Epf Advance Construction Of House Epf Withdrawal Limit Pf House Construction Youtube

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

How To Withdraw Epf And Eps Online Basunivesh

How To Withdraw Epf For House Construction In Just 5 Minutes Youtube

Pf Money Withdrawal Step By Step Guide To Do It Online Provident News India Tv

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Kwsp Housing Loan Monthly Installment

Pf Withdrawal Process Online 2021 Pf Advance Limit And How Many Times Advance Pf Can Be Withdrawn Youtube

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Epf Withdrawal Rules 2022 All You Need To Know

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia